Bitcoin (BTC), the world’s leading cryptocurrency, is subject to a variety of influences that drive its price. Understanding these factors can help investors and enthusiasts make informed decisions. This article explores the key drivers behind BTC’s current price, examining both short-term and long-term influences, and providing insights into analytical approaches.

Key Factors Influencing BTC Price

Market Sentiment and Investor Behavior

Market sentiment plays a crucial role in Bitcoin’s price. Positive news, such as major companies adopting Bitcoin or influential figures endorsing it, can drive prices up as investor confidence grows. Conversely, negative news, such as security breaches or regulatory crackdowns, can lead to panic selling and price drops. Investor behavior, influenced by fear and greed, often leads to significant price volatility.

Regulatory News and Government Policies

Regulatory news and government policies are major influencers of BTC price. Announcements of favorable regulations or the adoption of Bitcoin as legal tender can boost its price, while strict regulations and bans can have a negative impact. The regulatory landscape for cryptocurrencies is continually evolving, making it a critical area for investors to monitor.

Technological and Economic Drivers

Technological Advancements and Adoption

Technological advancements in the Bitcoin network and broader blockchain technology can drive BTC’s price. Improvements such as the Lightning Network, which enhances transaction speed and reduces costs, can increase Bitcoin’s utility and attractiveness to users and investors. Additionally, growing adoption by businesses and financial institutions adds to its legitimacy and demand.

Macroeconomic Trends

Macroeconomic trends also significantly influence btc price now. Factors like inflation, interest rates, and economic stability impact investor behavior. During times of economic uncertainty, Bitcoin is often seen as a hedge against inflation, leading to increased demand and higher prices. Conversely, strong economic conditions can reduce the perceived need for such a hedge.

Short-Term vs. Long-Term Influences

Short-Term Market Movers

Short-term market movers include news events, market sentiment, and technical trading patterns. Sudden news, such as regulatory announcements or major market developments, can cause immediate and significant price fluctuations. Short-term traders often capitalize on these movements, contributing to the volatility of BTC price now.

Long-Term Trends and Predictions

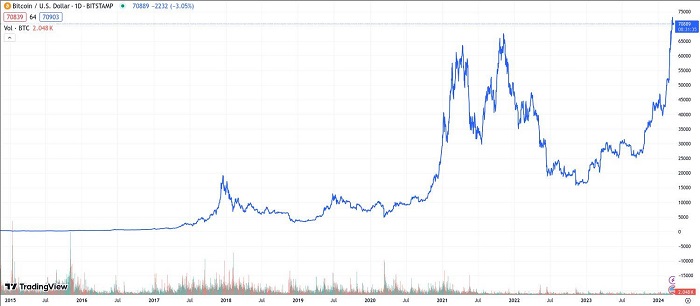

Long-term trends and predictions for Bitcoin are based on broader economic factors, technological adoption, and overall market acceptance. Analysts often look at historical data, adoption rates, and macroeconomic indicators to make long-term btc price prediction. While short-term fluctuations are common, the long-term outlook for Bitcoin is often more stable and growth-oriented.

Analytical Approaches to BTC Price

Technical Analysis Tools

Technical analysis involves using historical price data and trading volumes to predict future price movements. Common tools include moving averages, Relative Strength Index (RSI), and Bollinger Bands. These tools help traders identify trends, price patterns, and potential entry or exit points.

Fundamental Analysis Methods

Fundamental analysis focuses on the intrinsic value of Bitcoin by examining factors such as network activity, adoption rates, and macroeconomic conditions. Key metrics include the number of active addresses, transaction volumes, and hash rate. This approach helps investors understand the underlying value and potential growth of Bitcoin.

Case Studies of Influences on BTC Price

Major Historical Events

Major historical events have had lasting impacts on Bitcoin’s price. For example, the 2013 Mt. Gox hack led to a significant price drop, while the 2017 bull run, fueled by increased retail investor interest, saw Bitcoin reaching new highs. Understanding these events helps in recognizing how external factors can drive price changes.

Recent Developments

Recent developments, such as the increasing adoption of Bitcoin by financial institutions and the introduction of Bitcoin ETFs, have influenced BTC price. Additionally, macroeconomic events like the COVID-19 pandemic have highlighted Bitcoin’s role as a potential hedge against economic instability.

Conclusion

Understanding the factors driving BTC price now is essential for making informed investment decisions. Market sentiment, regulatory news, technological advancements, and macroeconomic trends all play significant roles in shaping Bitcoin’s price. By employing both technical and fundamental analysis, investors can better navigate the complexities of the Bitcoin market and capitalize on its potential.